Air passenger demand sees robust growth rates in 2013

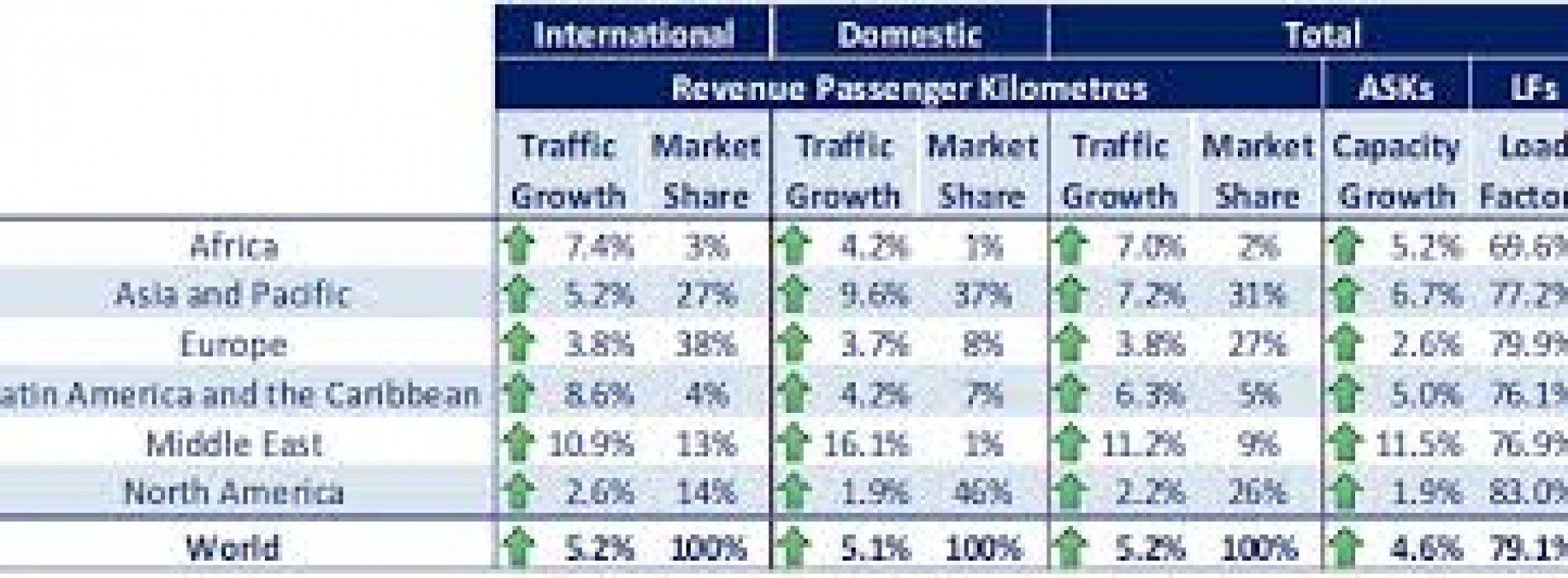

The 2013 performance aligns with the average annual growth rate of the past 30 years. Capacity rose 4.8% and load factor averaged 79.5% up 0.4 percentage points over 2012.Demand in international markets (5.4%) expanded at a slightly faster rate than domestic travel (4.9%).Strongest overall growth (domestic and international combined) was recorded by carriers in the Middle East (11.4%) followed by Asia-Pacific (7.1%), Latin America (6.3%) and Africa (5.2%). The slowest growth was in the developed markets of North America (2.3%) and Europe (3.8%).

“We saw healthy demand growth in 2013 despite the very difficult economic environment. There was a clear improvement trend over the course of the year which bodes well for 2014. Last year’s demand performance demonstrates the essential and growing role that aviation-enabled connectivity plays in our world. And with system-wide load factors at 79.5% it is also clear that airlines are continuing to drive efficiencies to an ever-higher level,” said Tony Tyler, IATA’s Director General and CEO.

International Passenger Demand International passenger demand grew by 5.4% in 2013 compared to 2012 with all regions reporting growth. Capacity rose 4.9%, boosting load factor to 79.3%, up 0.4 percentage points over 2012. Asia-Pacific airlines’trafficrose 5.3% in 2013, the highestincrease among the three major regions and slightly above 2012 annual growth of 5.2%. After a slow start, carriers in the region saw a pick-up in demand in the third quarter, supported by stronger performance of major economies such as China and Japan. Capacity expansion of 5.2%meant load factor was virtually flat at 77.7%.Europeancarriers saw trafficrise 3.8% in 2013 compared to 2012, a slowdown compared to annual growth of 5.3% in 2012. Capacity rose 2.8% and load factor was 81%, second highest among the regions and a 0.5 percentage point rise over 2012. Modest economic improvements in the Eurozone since the second quarter and rising consumer and business confidence are providing a stronger demand base for international travel; and after weakness in previous months, job losses in the Eurozone stabilized in December.

North American carriersreported the slowest passenger growth of any region at 3.0% compared to 2012 but an improvement over 2012 growth of 1.3%.With capacity up just 2.2%, load factor rose 0.8 percentage points to 82.8%, the highest for any region. The economy is showing some positive signs: employment growth has picked up, as has consumer spending.

Middle East airlinesrecorded the strongest increase in passenger traffic in 2013, a riseof 12.1% compared to 2012, but below the 15.4% growth recorded in 2012 compared to 2011.Carriers in the region have benefitted from the continued strength of regional economies, particularly Saudi Arabia and the United Arab Emirates and solid growth in business-related premium travel, particularly to developing markets such as Africa. However, capacity grew faster at 12.8% and load factor declined slightly by 0.1 percentage points to 77.3% from 77.4% in 2012.

Latin American carriersposted an 8.1% rise in demand in 2013 over 2012, down slightly compared to the 8.4% rise in 2012. This was the second-strongest performance (after the Middle East) and was supported by the healthy expansion of economies like Colombia, Peru and Chile. Capacity expanded 7.4% year over year, causing load factor to climb to 79.2%, up 1.3 percentage points compared to 2012.

African airlines’demand rose 5.5%, slightly above the global average but below 2012 growth of 7.5%. Capacity expansion of 5.2% meant load factor rose 1.9percentage points to 69%, the lowest among the regions. Overall, the demand environment is strong, with robust economic growth of local economies and continued development of internationally trading industries. But some parts of the continent have shown weakness including South Africa, which recently experienced a slowdown in its economy, with a corresponding impact on the demand base for international air travel.

Domestic Passenger Demand

Domestic air traveldemand rose grew by 4.9% in 2013 compared to 2012, up from 4.0% in 2012 versus 2011. Capacity rose 4.6% and load factor climbed 0.4 percentage points to 79.9%. All markets recorded positive gains, with the strongest growth occurring in China and Russia.

US trafficexpanded by1.9% in 2013 (up from 0.8% in 2012), while capacity grew at the same rate, with the result that load factor was flat at 83.8%, the highest for any market. The improvement in demand compared to 2012 reflects sustained increases in consumer confidence throughout the year as well as rising employment activity, particularly over recent months.

Chinatraffic climbed 11.7% in 2013 compared to 2012, the strongest for any market. Capacity rose 12.2% last year, with the result that load factor declined 0.6 percentage points to 80.3%, which was still the second best among markets.

Japan’s domestic market improved significantly in 2013 as annual demand rose5.2% (up from 3.6% in 2012) while capacity expanded by 5.1% and load factor was little changed at 64.3%, by far the lowest for any market. Significant government stimulus led to an acceleration in the economy in the first half of 2013 which supported increases in business activity and improving employment rates, boosting air travel demand. Brazil’s airlines recorded the slowest demand growth last year, with traffic up just 0.8% compared to 2012. Efforts by the government to stimulate the economy have borne little fruit, however capacity reductions by airlines of 3.3% pushed load factor to 76.3%, well above the 71.8% recorded in 2012. Indian domestic traffic rose 4.0% last year, compared to a 2.1% decline in 2012. The demand environment has been challenging in view of the weakening economy, high inflation and slowing manufacturing and resource industries. Capacity climbed 3.5% in 2013, and load factor was 74.6%, up 1.7 percentage points compared to 2012.

Russia had the secondstrongest domestic market, with demand up 9.6% in 2013 on a 9.1% rise in capacity. Russian demand is being supported by a resilient labor market and government policy focused on maintaining high employment and sustained income levels. Load factor was 74%. Australianairlines’ domestic traffic rose 2.8% in 2013 compared to 2012, while capacity rose 3.8%, depressing load factor 1.0 percentage point to 76.5%. Interest rate cuts have failed to stimulate the economy, which remains broadly sluggish, with rising unemployment and fragile business and consumer confidence.

The Bottom Line

Commercial aviation is celebrating its first century in 2014. “What was impossible yesterday is an accomplishment of today, while tomorrow heralds the unbelievable.” With these words, Percival Fansler, creator of the St. Petersburg-Tampa Airboat Line, inaugurated the era of commercial aviation on 1 January 1914. “Fansler was right. The first century of commercial aviation has changed the world. It has made it a better place through connectivity. Forward-looking governments recognize the power of aviation to drive economic growth and spread prosperity. These governments are laying the foundations for our next century and in doing so will reap enormous benefits. But not all governments are on the same page. This anniversary year is an opportunity to remind short-sighted governments that they risk being left behind if they cripple aviation with taxes, over-burden it with onerous regulation, or fail to provide the infrastructure that it needs to grow,” said Tyler

“We saw healthy demand growth in 2013 despite the very difficult economic environment. There was a clear improvement trend over the course of the year which bodes well for 2014. Last year’s demand performance demonstrates the essential and growing role that aviation-enabled connectivity plays in our world.,”

Box Highlights of IATA’s Air passenger market analysis 2013

• Air travel markets grew by 5.2% in ‘13 against ‘12, despite high fuel costs, slow global economic growth.

• Growth in air travel was driven by solid economic expansion in emerging regions, where less mature air travel markets continue to increase strongly.

• Airlines in mature markets of Europe and North America experienced the slowest rates of expansion in ‘13, rising 3.8% & 3.0% respectively.

• Both regions saw some recovery in air travel growth in ‘13, but growth rate was far slower than in emerging market regions.

• Carriers in the Middle East recorded the strongest increase in ‘13, gained 12.1% compared to ‘12.

• Airlines in Latin America saw growth of 8.1% in ‘13.

• Domestic air travel increased by a strong 4.9% in ‘13, China, Russia recorded the strongest growth rates.

• International air travel recorded robust growth in ‘13, rising 5.4% compared to ‘12.

• Growth in international travel on Latin American carriers was also strong in ‘13, gaining 8.1% compared to ‘12.

• Asia Pacific airlines experienced a rise of 5.3% for the year as a whole, in line with ‘12.

• African airlines international air travel expanded by 5.5% ‘13, solid but slower than in ‘12 (7.5%).

• Domestic air travel in China and Russia recorded the strongest rates of increase.

• Air travel in China expanded 11.7% in ‘13. It is the strongest performing domestic market.

• Russian domestic air travel volumes expanded 9.6% in ‘13.

• Other BRIC states – Brazil and India – have seen considerably slower rates of growth in domestic travel, 0.8% and 4.0% respectively.

• Japan’s domestic air travel market improved significantly in ‘13, expanding 5.2%.

• In the US, domestic air travel expanded 1.9% in ‘13, which is more than double the pace of growth in ‘12.

• Australia domestic market recorded growth of 2.8% in ‘13.

You might also like

Ethiopian to link Chengdu with Africa

Africa’s largest airline group, Ethiopian Airlines, is delighted to announce that it has concluded preparations to start new flight to Chengdu, China three times weekly as of June 3, 2017.

Air India communications go global with SITA

Air India has introduced a new communications solution that will link its global airport teams. Using SITA Connect, the national carrier will be able to link its central hubs in

India speeds up Delhi-Mumbai rail plan

The Indian government is accelerating its plan to speed up the key Delhi-Mumbai railway line, by ordering a new high-speed train that can operate on the existing tracks. The Economic