The Hospitality Industry disappointed over the GST rates for hotels & restaurants

The GST Council recently pegged 18% GST rate for hotels charging room rentals between `2500 and `5000 and 28% for those charging above `5000.

The Good & Service Tax Council recently announced the rate structure for goods and services. The GST is scheduled to be rolled out from July 1. The council has made distinction between the rates for luxury products vis-à-vis the rates of essential and common usage items. While most essential and common usage goods and services have been placed in the category of GST on or below 18%, quite a few luxury goods and services have been kept at the higher rate of 28%. The GST council has pegged GST for AC eateries and those with liquor license at 18%, non-air-conditioned restaurants at 12%, hotels charging room rentals between `1000 and `2500 at 12%, `2500 and `5000 at 18% and above `5000 at 28%. The hotel industry is disappointed over the GST rates for hotels and restaurants. The industry fears that taxing hospitality services at such a high rate will adversely impact the industry. Terming the rates as too complex, high and uncompetitive, the hotel industry has made representation to the Finance Minister and Tourism Minister to review the rates once again.

Following the announcement of GST rate slabs for services, where the hotel industry has been kept in the upper tax slab of 28 %, the Federation of Associations in Indian Tourism & Hospitality (FAITH), the apex body of India’s travel and tourism industry, has expressed its concerns to Finance Minister Arun Jaitely on placing the hospitality industry in the high tax bracket under GST regime. It has expressed its concerns in a letter addressed to the FM, documenting major impediments. Under the proposed GST rate slabs, hotels and similar accommodation with a rate of above `5000 have been classified as luxury and put under a newly created bracket of 28% for services. In addition, for consumption in restaurants in a property which is classified as 5- star and above, the GST rate has been pegged at 28%.

Dr. Ankur Bhatia, Executive Director, Bird Group, commented that the hospitality industry in India, a big contributor to the country’s economic growth is on high growth trajectory. “The industry also contributes significantly to employment, FDI and Foreign exchange. However, recently the industry has been severely impacted by the liquor ban imposed by the Supreme Court and the much awaited GST rates have come as another shocker,” said Dr. Bhatia, adding that these high and complex GST rates will create further impediments to the industry’s growth which is still maturing, while the new tax structure will also position India poorly as a destination visa vie our competitors in the international market that have much lower taxation.

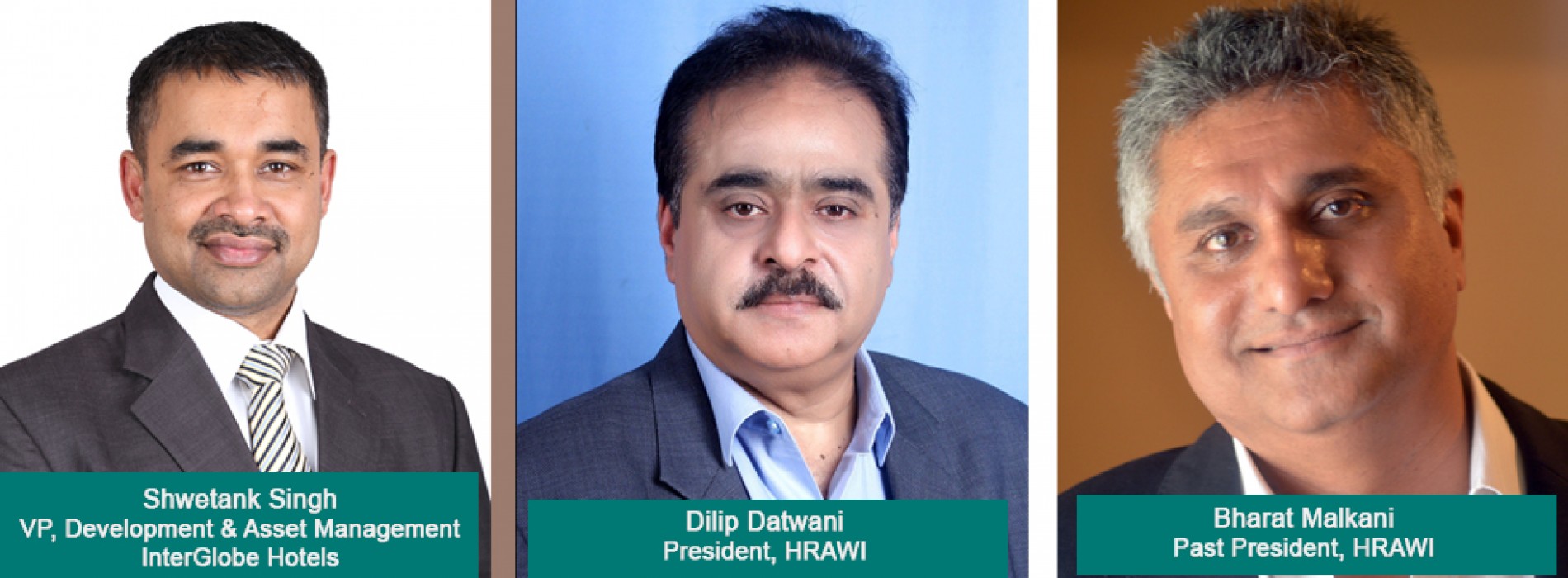

Expressing his disappointment over the rates of GST, Dilip Datwani, President, Hotel and Restaurant Association of Western India (HRAWI) said that the Government should realize that while neighbouring countries like Myanmar, Thailand, Singapore, Indonesia and others levy taxes ranging from 5 to 10%, “India cannot afford to have these kind of complex and high GST. Tourists will simply skip India. Being the backbone of the tourism industry, it was expected to be placed in the 5% slab.”

Bharat Malkani, Past President, HRAWI said, “One of the biggest hurdles for Indian hospitality and tourism, in terms of attracting international tourists is its uncompetitive tax structure. A country as small as Singapore witnesses 10.90 million tourists against 6.31 million for India. Nations like Malaysia and Thailand attracted 24.7 million and 19.09 million tourists in 2014 and earned foreign exchange of USD 18,299 million and USD 26,256 million. In contrast, India managed to earn a meagre USD 94 million.”

“Hospitality is not only one of the highest foreign exchange grossers, but also one of the largest tax generators for the exchequer. It is also one of the highest employment generating industries, employing a large number of youth in the country and 70 per cent of India’s population is below the age of 35 years. This section of the population too will definitely be affected adversely. By the Prime Minister’s own declarations, the growth of the nation will parallel the growth of tourism. So, it is perplexing that the industry is being taxed to death. If GST is not reconsidered, foreign exchange inflow will dry up sooner than later,” says Gurbaxish Singh Kohli, Sr. Vice President, HRAWI.

Budget and mid-market hoteliers have welcomed the lower GST rates to be levied on budget and mid-market hotels, Ritesh Agarwal, Founder & CEO, OYO, while welcoming the step, said, “A lower tax rate for budget hotels sector will ensure that the industry’s quality upgrade continues while delivering standardized accommodation to millions of middle-class travellers. Currently lower budget hotels make up about 80 percent of the hospitality market in India. This will also save and create thousands of new jobs which could have been impacted under higher tax-rates. Hotels are the single biggest contributor to tourism industry which accounts for 7.5 per cent of the GDP. The move will boost revenue from Travel & Tourism sector for the next many years.”

Welcoming the lower tax rates introduced for budget hotels, Sidharth Gupta, Co-Founder, Treebo Hotels, said that 75- 80% of Treebo’s inventory lies in the `1,000-2,500 price band. The GST applicable in this band is 12% as opposed to 17-20% applicable earlier. This means that our rooms will now be even more affordably priced, and many more customers will be able to benefit from the highest quality accommodation services we offer.”

Shwetank Singh VP – Development & Asset Management- InterGlobe Hotels said, “GST is a great move to make the tax base transparent and inclusive. It will bring in a lot of simplicity in the current taxation structure that comprises various levies and is complex for the end consumer. As per the proposed structure, the hotels that have room rates above INR 5000 will fall in the higher tax bracket whereas, for the mid-market and economy range, the business continues unwavering in the 18% bracket. We need to wait and watch the space for F&B as the classification is a bit complicated owing to divisions based on airconditioning. I feel, there is a further need for the Government to simplify this so as to curb any inflationary trends due to the new tax regime.” Internationally, the taxes in neighbouring countries like Myanmar, Thailand, Singapore, Indonesia range between 5% and 10%. The high incidence of taxes will make India uncompetitive when it comes to Tourism.

You might also like

Air India cancels flight to accommodate Haj pilgrims

Even as Congress MP Shashi Tharoor took to Twitter on Thursday criticising Air India for cancelling its scheduled flight from Thiruvananthapuram to Bengaluru from August 23 to 27, which is

The first Israel ministry of tourism’s campaign in India

In August, the Israel Ministry Of Tourism Office in India has launched an all India advertising campaign for the first time on this scale, that will run for a period

Over 950,000 places to stay are now accessible through flydubai.com

flydubai partners with Booking.com! Dubai-based flydubai is partnering with Booking.com, the global leader in connecting travellers with the widest choice of incredible places to stay, adding a wide range of