Exemption on service charge on train tickets till September

The service charges on booking train tickets online through IRCTC range from Rs 20 to Rs 40 per ticket.

Train passengers will continue to get benefits of a service charge exemption on tickets booked online till September. The government had waived service charges after demonetisation in November last year to encourage digital modes of booking. The service charges on booking train tickets online through IRCTC range from Rs 20 to Rs 40 per ticket.

To promote digital modes of payment, the government decided post demonetisation that service charge on online booking of train tickets would be withdrawn for tickets booked from November 23, 2016, to March 31, 2017. Later, the government extended the exemption period to June 30.

Now, the exemption on service charge has been further extended till September-end this year, said a senior Railway Ministry official. The government has done this to help passengers and promote payments made through digital modes.

IRCTC, the ticketing agency of the railways, is expected to lose about Rs 500 crore a year due to the exemption. The Railway Ministry has written to the Finance Ministry seeking reimbursement of the loss. IRCTC shares half of the service charge revenue with the railways.

News Source: PTI

You might also like

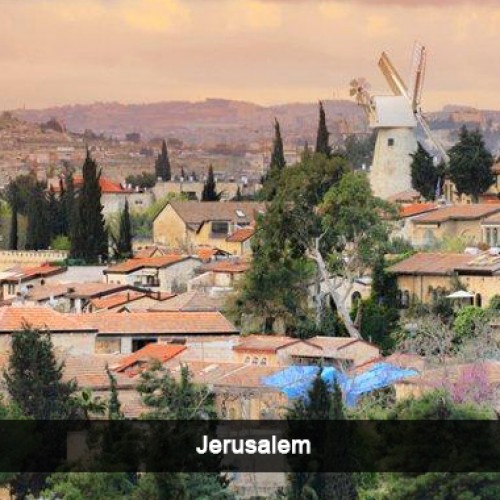

Israel Ministry of Tourism conducts Six-city roadshow in India

In continuation of its plan to increase the number of Indian arrivals to the country, the Israel Ministry of Tourism (IMOT), conducted their second roadshow for 2017 in India. The

Boeing delivers first 737 MAX 8 to flydubai

All-Boeing carrier is first in Middle East to operate Boeing’s newest single-aisle airplane. Boeing and flydubai celebrated the delivery of the airline’s first 737 MAX 8, making the Middle East

Treebo Hotels earns 2016 Tripadvisor Certificate of Excellence for 9 Properties

Treebo Group of Hotels, the Bangalore-based chain of budget hotels has announced receiving the TripAdvisor® Certificate of Excellence for 9 of its properties for 2016.In its sixth year, the achievement