Thomas Cook (India) Limited announces strong consolidated results for the year ended March 31, 2017

Group Consolidated:

⦁ Total Income increase of 41% from Rs. 61.6 Bn. to Rs. 86.8 Bn.

⦁ PBT (before exceptional items) increased by 101.9% from Rs 947.7 Mn. to Rs. 1,913.7 Mn.

⦁ Book value increased from Rs. 36.91 / share to Rs. 49.11 / share ( 33% growth)

Group Travel Services:

⦁ Operating Revenue from Travel businesses up 79.7% from Rs. 21.8 Bn. to Rs. 39.1 Bn.

⦁ PBT increased by 1203% from Rs 83.1 Mn. to Rs. 1083.4 Mn.

⦁ Book value increased from Rs. 51 / share to Rs 72 / share (41% growth)

The Thomas Cook India Group today declared its consolidated Financial Results for the year ended March 31, 2017. The Group has announced an increase in Total Income from Rs. 61.6 Bn. during the year ended March 31, 2016 to Rs. 86.8 Bn. for the year ended March 31, 2017.

Consolidated PBT (before exceptional items) increased from Rs. 947.7 Mn. for the year ended March 31, 2016 to Rs. 1,913.7 Mn. for the year ended March 31, 2017 – a growth of 101.9%. On an annualized basis, the consolidated travel businesses of the group saw a revenue growth of 79.7% from Rs. 21.7 Bn. to Rs. 39.1 Bn.

The Company’s announcement of its consolidated Financial Results for the year ended March 31, 2017 is in line with the new accounting standards (Ind-AS – Indian Accounting Standards) which is required to be followed for both standalone financials and consolidated financial statements. Quess Corp saw Gross revenue up 21% from Rs. 34. 3 Bn. during the 12 month period ended March 31, 2016 to Rs. 41.4 Bn. for the 12 month period ended March 31, 2017.

Sterling Holiday HYPERLINK “http://www.thomascook.in/tcpo

Commenting on the Results, Mr. Madhavan Menon, Chairman & Managing Director, Thomas Cook (India) Ltd. said, “Despite numerous geo-political and related challenges for our core Travel and Forex businesses, the Group’s strong performance for the year, gives us further conviction that our strategy of organic and inorganic growth backed by the twin enablers of technology and innovation are working well. The synergistic advantages we had foreseen from our acquisition of SOTC, Sita and Kuoni Hong Kong in 2015 are also well on track to deliver.”

“Going forward, with our recently announced agreement to acquire Kuoni’s global network of Destination Management Specialists across 17 countries, we now have a significant expanded global footprint spanning the Americas, Middle East, Africa, Asia and Australia. This global acquisition, further underlines our commitment at Thomas Cook India Group – to invest and grow our businesses globally, to create strong value for our stakeholders.”

About Thomas Cook (India) Limited: Thomas Cook (India) Ltd (TCIL) is the leading integrated travel and travel related financial services company in the country offering a broad spectrum of services that include Foreign Exchange, Corporate Travel, MICE, Leisure Travel, Insurance, Visa & Passport services and E-Business. The company set up its first office in India in 1881.

TCIL’s footprint (exclusive of its subsidiaries) currently extends to over 223 locations (including 21 airport counters) in 85 cities across India, Mauritius & Sri Lanka and is supported by a strong partner network of 91 Gold Circle Partners and 81 Preferred Sales Agents in over 87 cities across India.

ICRA has retained the long-term rating of TCIL’s non-convertible debenture programme at ‘ICRA AA/Stable’. CRISIL has assigned a long term rating of ‘CRISIL AA– / stable’ to the non-convertible debenture programme and long-term banking facilities, and a short-term rating of ‘CRISIL A1+’ to TCIL’s banking facilities. Further, ICRA has retained the rating of ‘ICRA AA– / Stable’ on the Company’s preference share programme.

TCIL has been voted as Favourite Outbound Tour Operator at the Outlook Traveller Awards 2015; Best Tour Operator- Outbound at the CNBC AWAAZ Travel Awards 2015, 2014 & 2013; Best Company providing Foreign Exchange at the CNBC AWAAZ Travel Awards 2015 & 2014; felicitated with The French Ambassador’s Diamond Award for Exemplary Achievements in Visa Issuance 2015 & 2016; Condé Nast Traveller Readers’ Travel Awards 2016 to 2011. TCIL’s Travel Quest was honoured at PATA Gold Awards 2015 and TCIL’s Centre of Learning has received IATA accreditation as Top 10 South Asia IATA Authorized Training Centers 2016, 2015, 2013 & 2012. For more information, please visit www.thomascook.in

TCIL is promoted by Fairfax Financial Holdings Limited through its wholly-owned subsidiary, Fairbridge Capital (Mauritius) Limited and its controlled affiliates which holds 67.66%. Fairbridge is responsible for the execution of acquisition and investment opportunities in the Indian subcontinent on behalf of the Fairfax family of companies. Equity shares of TCIL are listed on BSE and NSE under the Scrip Code – 500413 and THOMASCOOK respectively.

About Fairfax Financial Holdings Limited: Fairfax Financial Holdings Limited is a holding company which, through its subsidiaries, is engaged in property and casualty insurance and reinsurance and investment management. The company was founded in 1985 by the present Chairman and Chief Executive Officer, Prem Watsa. The company has been under present management since 1985 and is headquartered in Toronto, Canada. Its common shares are listed on the Toronto Stock Exchange under the symbol FFH and in U.S. dollars under the symbol FFH.U.

The company, through Thomas Cook (India) Ltd., owns 62.17% of Quess Corp Limited (formerly IKYA Human Capital Solutions Limited), a provider of integrated business services, and 100% of Sterling Holiday Resorts Limited (formerly Thomas Cook Insurance Services (India) Limited), a company engaged in time share and resort business.

About Quess Corp Limited: Quess Corp Limited (BSE: 539978, NSE: QUESS), established in 2007, is India’s leading integrated business services provider. Based out of Bengaluru, Quess today has a pan-India presence with 65 offices across 34 cities along with overseas footprint in North America, the Middle East and South East Asia. It serves over 1700+ customers across 4 segments namely, Global Technology Solutions, People & Services, Integrated Facility Management and Industrials. In FY17, Quess generated revenues of INR 4,157 Crores and had over 159,200 employees. Quess has a Market Capital of over INR 10,000 Crores as on April 30, 2017. For more information, please visit www.quesscorp.com

About Sterling Holiday Resorts Limited: Sterling Holiday Resorts Limited is a leading holiday lifestyle company in India. Sterling was incorporated in 1986 with the vision of delivering Great Holiday experiences to Indian Families. To achieve this vision, the company pioneered Vacation Ownership in India and set about building a network of leisure resorts at some of the best holiday destinations in India. Currently, Sterling (including Nature Trails Resorts) has an inventory of 2124 rooms spread across 32 resorts located in Agra, Anaikatti, Corbett, Daman, Darjeeling, Dindi, Dhabosa, Dharamshala, Durshet ,Gangtok, Goa, Karwar, Kodaikanal, Kufri, Kundalika, Lonavala, Manali, Munnar, Mussoorie, Nainital, Ooty, Puri, Sajan, Sariska, Shirdi, Thekkady, Yelagiri and Yercaud. The company also has 16 additional sites where it plans to add new resorts in the coming years.

In March 2016, Sterling Holidays acquired ‘Nature Trails Resorts Private Limited’ – an adventure holiday company that operates resorts at four unique destinations in Maharashtra. For more information, please visit www.sterlingholidays.com

About SOTC Travel Services Pvt Ltd (formerly Kuoni Travel (India) Pvt. Ltd) & Travel Circle International Services Limited (Formerly Kuoni Travel (China) Limited): SOTC Travel Services Pvt Ltd (Formerly “Kuoni Travel (India) Pvt. Ltd.”) is a step-down subsidiary of Fairfax Financial Holdings Group; held through two companies, its Indian listed subsidiary, Thomas Cook (India) Limited (TCIL) and TCIL’s subsidiary Travel Corporation (India) Ltd. SOTC is a leading travel and tourism company active across various travel segments including Leisure Travel, Incentive Travel, Business Travel, Destination management Services and Distribution Visa Marketing Services.

TCIL through its step down Subsidiary Travel Circle International Limited (formerly Luxe Asia Travel (China) Limited ) held 100% stake in Travel Circle International Services Limited (formerly Kuoni Travel (China) Limited), which has an attractive business in the travel sector backed by a trusted brand name, and a stable and motivated professional management team. The company is a premium outbound travel operator in Hong Kong. The Company Travel Circle International Services Limited has been merged with Travel Circle International Limited w.e.f. December 13, 2016.

You might also like

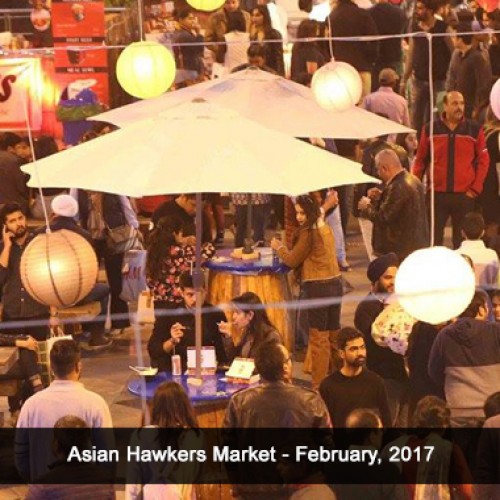

India’s biggest Pan-Asian Food Fest is back

The Asian Hawkers Market (AHM) is back for its fifth season on what promises to be an action-packed pre-Diwali weekend (October 13-15, 2017) at Select Citywalk, Saket. There’s never an

Experience Oman’s rich wildlife and nature

Oman’s natural reserves and wildlife sanctuaries protect important coastal and desert habitats totaling almost 30,000kms. The sheer diversity of Oman’s landscapes will astonish and inspire you. Oman’s coastal waters are

AirAsia India says GST to shave off Rs 400 crore from airlines

Low-cost carrier AirAsia India today said the new tax regime will leave the aviation industry poorer by about Rs 400 crore annually if the government does not roll back the